Coronavirus: How to prepare for uncertain times

Uncertainty is a fact of life. There are many situations outside our control and these events can hurt your investments. While controlling the markets may be out of our reach, we can easily plan to stay protected and minimise the damage.

Here are some approaches that can help us to plan for uncertain times.

Have an emergency fund

An emergency fund is a must for a stable financial life. In case of any emergency, without an emergency fund, your entire savings may be drained. Having an emergency fund with at least three to six months of expenses will help you overcome unexpected conditions such as job loss or a health emergency.

In case of a market decline because of economic reasons or a virus outbreak like COVID 19, it is crucial to have easy access to liquid cash. In such situations, there are higher chances of cutbacks and medical emergency.

Liquid fund and savings account can help you build your emergency fund and give access to easy liquidity. Now, one can redeem their money from the liquid fund which is deposited in a savings account immediately. As per the SEBI guidelines, investors can redeem up to Rs.50,000 or 90% of the amount, whichever is lower, instantly.

Focus on your goals:

Equity markets are volatile in the short run. But, in the long run, equity markets offer higher returns than other asset classes.

In cases of extreme volatility, it is tough to maintain our cool. It is easier to make reckless judgments which can have negative effects on our portfolio. In these conditions, it is vital to pay attention and make the right investment decisions.

The best way to control impulsive reaction is to focus on your goals. Has the present scenario altered your long term financial goals? If not, there is no reason to overreact and staying invested is the best financial decision.

Don’t stop your SIP

Systematic Investment Plan (SIP) is an easy way to invest in mutual funds. We notice that investors stop their SIP investment when the markets is going through a rough phase.

However, stopping your SIP or trimming your SIP amount can have a detrimental impact on your portfolio and you may have to stick around further to complete your financial objectives.

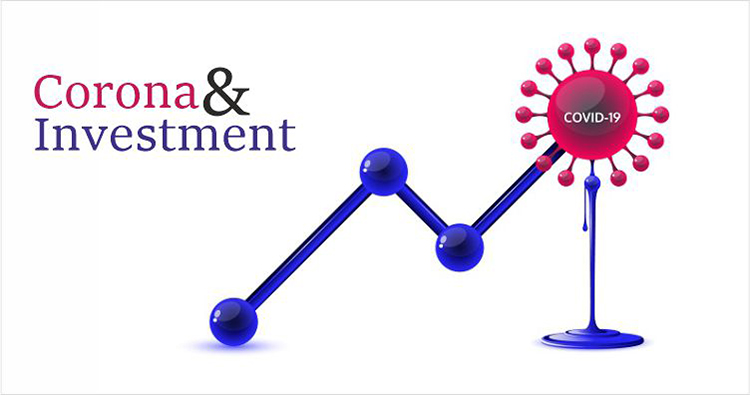

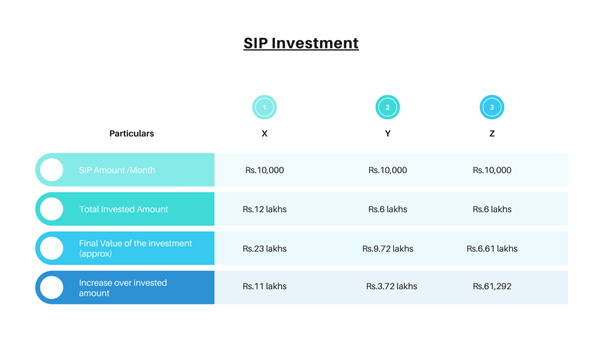

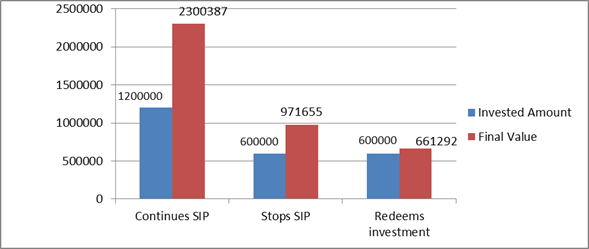

Let us show this with an example. Let us assume that three friends X, Y and Z started investing Rs.10,000 every month for 10 years.

After five years, the markets fell 10% in a single day. Till that drastic decline, equity markets gave an average return of 8%.

In this scenario, three friends took different actions. X continued with his SIP, Y stopped SIP but did not redeem the invested amount, and C stopped SIP and redeemed his entire investment.

Going forward, the market recovers and gains another 8% returns in the next five years. Overall, the market gave an average return of 12% in 10 years.

Here’s how the portfolio of X, Y, and Z would look like in 10 years.

Here, we see that X stayed invested for the entire duration, X accumulates more than Rs.23 lakhs against an initial investment amount of Rs.12 lakhs.

As Y stops SIP but does not redeem the investment, Y’s invested amount of Rs.6 lakhs increased to Rs. 9.72 lakhs.

As Z stops the SIP and redeems the entire investment after five years, he gains Rs.61,292 against his initial investment of Rs.6 lakhs.

From this example, we can see that staying invested and continuing your SIP in volatile times can help you achieve your financial goals.

Rupee cost averaging is one of the important features of SIP. Taking the SIP route allows investors to average out the cost of investment as investors receive more units of the fund when the market is down and vice versa.

Asset Allocation:

Asset allocation is the investment strategy where the investment portfolio is segregated among different asset classes, as per the risk and investment goals of the investor. It is important to revise your asset allocation regularly. Your investment goals and risk-taking capacity may change over time, and optimal asset allocation in your portfolio will make sure you are on the right track.

If your financial goals have changed, you can tweak your portfolio accordingly. A financial advisor can help you do so.

Conclusion:

Markets are volatile in the short run. Staying prepared with an emergency fund, proper asset allocation and staying invested in the market through SIP are some ways that can help you overcome testing times and achieve your financial goals.

609-610, Pinnacle Business Park, Corporate Road, Near Prahladnagar Auda Garden, Satellite, Ahmedabad 380015.

103, Goodwill Bizhub, Plot No. C-3C, Next to Ikea TTC Industrial Area, Turbhe, Navi Mumbai. 400703.

+91 7940191105(Ahmedabad Office)

+91 8879338162(Mumbai Office)

+91 7940191103, 7940191104

Grievance Redressal

DISCLAIMER : Mutual Funds and securities investments are subject to market risks and there is no assurance or guarantee that the objective of the Scheme will be achieved. Past performance of the Sponsor/AMC/Fund or that of any scheme of the Fund does not indicate the future performance of the Schemes of the Fund. Please read the Key Information Memorandum and the Offer Document carefully before investing.

Safe Assets © 2021