Asset allocation is like the art of cooking. And just like with cooking, there are numerous elements such as the recipe, the ingredients you're using, and external factors that affect your end product. This blog post will discuss six elements that affect our asset allocation. We will discuss why you should consider these five elements before allocating your assets.

There are different types of assets, and all assets don't move in the same direction. For example, if the equity markets are falling, gold prices typically move up as stock prices and vice versa. It is because stock prices go up when the market is optimistic, and gold prices rise when it is pessimistic.

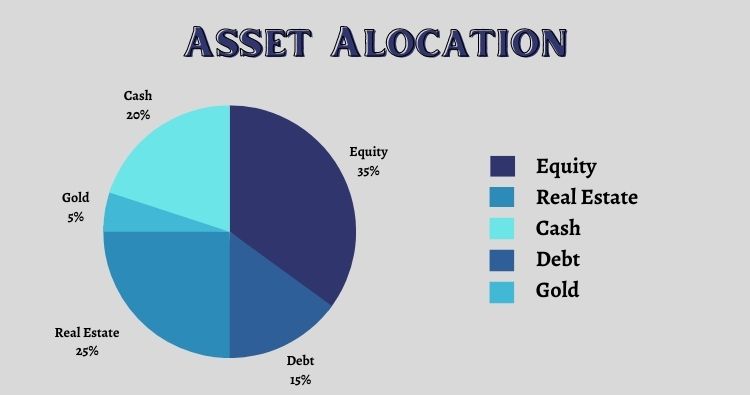

A proper asset allocation is necessary to get optimum returns from your investments. And this is where the concept of asset allocation enters. By investing in different classes of assets in the market, you can take reduce your portfolio risk.

Let's understand some elements that affect asset allocation.

Age is an essential element that affects asset allocation while investing in an instrument. For example, if you are a millennial, which means you are at the age of 20-35, you may have a high-risk tolerance as you have a long life ahead to achieve your long-term goals.

Similarly, if your age is between 35-55, you may have a moderate risk profile to invest in risky products. You may have already achieved your long-term goals and are willing to accomplish a few short-term objectives. And individuals aged more than 55 years may prefer the least riskier investment.

Income is another element that needs to be considered while deciding on asset allocation like job security, employed or unemployed, consistency in cash flow matters. If you are a salaried employee, you can systematically invest in different assets. But if you have a business, you may need to carry out asset allocation in a way that best suits you. If your income status changes, you can revise the asset allocation breakup to suit your current scenario.

Your investment horizon is another feature of your asset allocation. If you are looking forward to investing in a short-term financial goal, you can invest in fixed-income securities like fixed deposits and short term debt funds.

On the contrary, if you are planning to invest in a long-term instrument, you may invest in equities as it has the potential to deliver higher returns over the long term.

The amount of risk you can take with your money also impacts your asset allocation.

Risk-taking capacity can be divided into three parts:

Risk profile depends on your willingness to take the risk for your hard-earned money. Investing in stock markets are subject to market volatility risk. If you cannot bear the short term volatility in the equity markets, you can look at investing in debt instruments.

Liabilities also play an essential role in determining your asset allocation. It is because your liabilities influence your risk-taking capacity and financial goals. For instance, a 25-year old who lives with parents and doesn't have any liabilities may easily invest 90% of the income in equity funds. However, the same may not hold for a person who is the family's sole earning member. They might be more interested in saving money for emergencies or any short-term requirements.

Analyzing these factors can be proven helpful in allocating your assets while investing in different asset classes. We can see that these five factors are related to each other. You can determine the time horizon by deciding on your financial goals, your number of dependents and your age can help you understand your risk profile, and so on. It is essential to evaluate each element that may affect your assets allocation and investment category.

This blog is purely for educational purposes and not to be treated as personal advice. Mutual fund investments are subject to market risks, read all scheme-related documents carefully.

609-610, Pinnacle Business Park, Corporate Road, Near Prahladnagar Auda Garden, Satellite, Ahmedabad 380015.

103, Goodwill Bizhub, Plot No. C-3C, Next to Ikea TTC Industrial Area, Turbhe, Navi Mumbai. 400703.

+91 7940191105(Ahmedabad Office)

+91 8879338162(Mumbai Office)

+91 7940191103, 7940191104

Grievance Redressal

DISCLAIMER : Mutual Funds and securities investments are subject to market risks and there is no assurance or guarantee that the objective of the Scheme will be achieved. Past performance of the Sponsor/AMC/Fund or that of any scheme of the Fund does not indicate the future performance of the Schemes of the Fund. Please read the Key Information Memorandum and the Offer Document carefully before investing.

Safe Assets © 2021